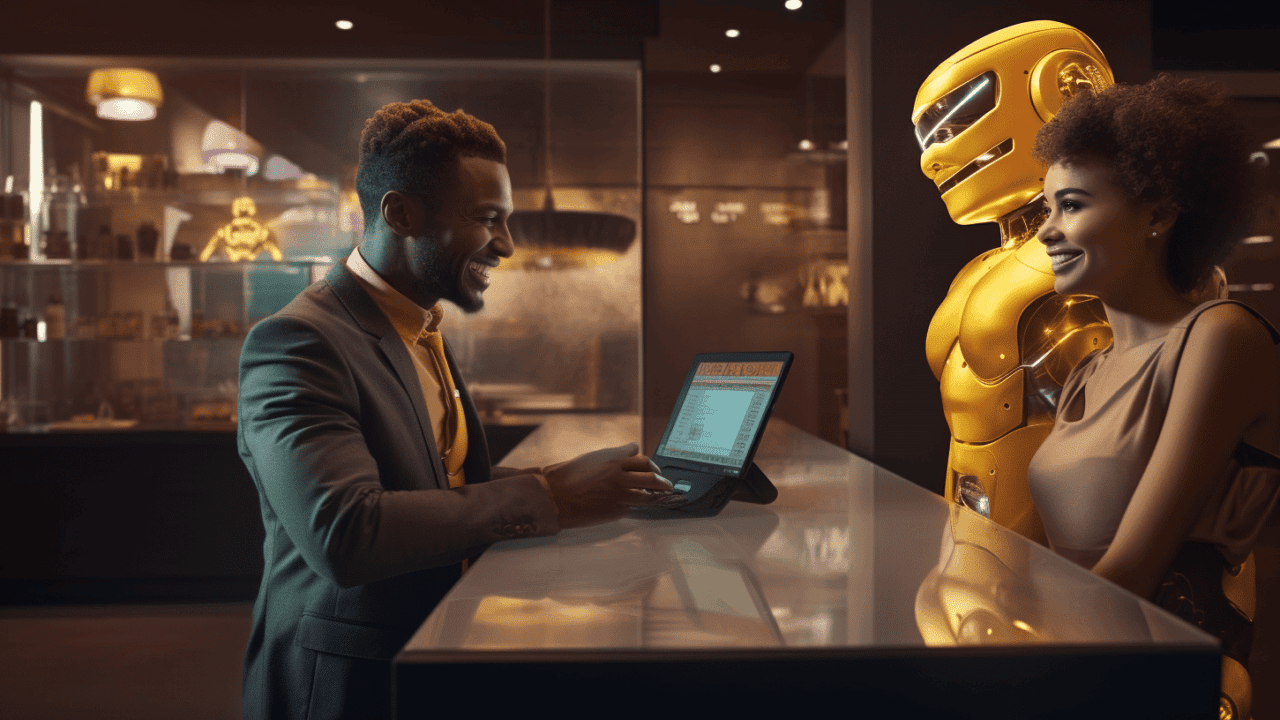

The banking industry is on the brink of an AI revolution, destined to redefine customer service and operational efficiency. Leveraging the capabilities of Artificial Intelligence (AI) and Machine Learning (ML), banks can personalize customer service, streamline operations, and offer unprecedented convenience. This article provides a deep dive into the enticing world of AI application in the banking sector, elucidating its transformational impact, potential risks, market share, and compelling use cases of generative AI. Let’s embark on this intriguing journey to understand how AI is reinventing customer experience in the banking world.

The Impact of AI on Customer Experience

Artificial Intelligence (AI) has undeniably redefined the customer experience landscape, transforming interactions between brands and consumers. Connected devices, consumer recommendations, and chatbots are all driven by AI and are playing an increasingly critical role in shaping customer journeys. In this section, we’ll explore the attitude of shoppers towards AI and their reactions to AI software integration.

Positive Perception of Shoppers Towards AI

In the world of commerce, consumers are warming up to AI at an unprecedented rate. It’s interesting to note that a staggering 73% of shoppers believe AI can positively impact their customer experience. This encouraging statistic underscores that shoppers are not only receptive to AI but look forward to experiencing its benefits.

The reason shoppers have a positive perception of AI comes down to the following factors:

- Increased speed and efficiency: Shoppers do not have to wait to get service, as AI-driven tools such as chatbots are available round the clock.

- Enhanced personalization: AI algorithms analyze customer behavior and pattern to deliver a personalized shopping experience.

- Improved accuracy: AI reduces human error in order processing, ensuring every order is accurate and timely.

This attitude of shoppers not only paves the way for more robust AI integration into customer service but also challenges brands to constantly innovate and improve their AI technologies.

Customer Reactions to AI Software Integration

When it comes to integrating AI software into customer service, the response from customers has been incredibly positive. In fact, research shows that nearly 80% of customers who interact with AI software for customer service had a positive experience.

Customers appreciate the instantaneity of AI systems, enjoying the immediacy of responses and the capability of addressing multiple queries simultaneously. They also praise the self-service opportunities presented by AI, allowing them to resolve their issues without requiring human intervention.

However, it’s critical for businesses to remember that with greater AI integration comes the responsibility of ensuring their systems are user-friendly and effective. Delivering a seamless and positive experience should be the ultimate goal, irrespective of the technology employed.

In the end, brands that are willing to embrace AI and relentlessly invest in improving its capabilities are the ones that will undoubtedly provide a superior customer experience and gain a competitive edge. The promising insights into customer experiences and reactions to AI serve as an incentive for brands to advance in their AI journey, consistently enhancing their customer interactions.

They pave the way for a future where AI not only enhances the customer experience but becomes essential to it.

The Potential Risks of AI in Financial Services

The advent of Artificial Intelligence (AI) has undoubtedly ushered in a new era of innovation and efficiency across various industries. Particularly in the financial sector, AI’s ability to analyze vast amounts of data enables firms to streamline operations, enhance customer experiences, and make more informed decisions. Yet, amidst these notable advantages, there’s an underbelly of potential perils. One significant cause for concern is the amplified risks of fraud and security breaches that AI potentially holds.

AI and Risks for Fraud and Security Breaches

Even as AI continues to carve out a significant niche for itself in the financial services sector, it’s essential to keep an equally keen eye on the potential risks associated with its use. The most prominent of these concerns is the elevated susceptibility to fraud and security breaches.

By synthesizing and analyzing colossal volumes of data, AI systems can spot patterns and trends that would be impossible for humans to detect. Regrettably, these capabilities which are assets for legitimate financial operations can also become weapons in the hands of cybercriminals. As technology advances, so too does the sophistication of the fraudulent schemes. Consequently, AI becomes a double-edged sword, offering efficiency and potential danger in equal measure.

There’s an underlying sentiment within the sector, voicing their concerns regarding AI’s role in financial services. In fact, according to a recent survey, a considerable 64% of respondents believe AI in financial services puts them at greater risk for fraud or security breaches.

This statistic signifies a credible apprehension that needs addressing. While AI brings about operational agility and accuracy, it should not be at the cost of increased susceptibility to fraudulent transactions and cyber threats. Financial service firms must remain diligent. They should constantly update their security protocols and invest in the latest technologies that safeguard against such risks. Only by striking the right balance can organizations truly integrate AI into their framework without compromising security and trust.

The march towards a technologically advanced financial sector is unstoppable. AI will undoubtedly play a crucial part in shaping the future of financial services. However, it’s equally important to recognize the potential hazards and work towards stronger safeguards, ensuring the safe and responsible use of this transformative technology.

AI Adoption by Retail Organizations for Customer Service Enhancement

In recent years, technology has revolutionized various industries, and retail is no exception. AI, Artificial Intelligence, has increasingly found its way into retail organizations. It’s intriguing to note that 63% of retail organizations already leverage AI technology to enhance customer service.

AI adoption marks a seismic shift in the retail landscape, reshaping traditional business operations and directly impacting customer experiences. Let’s dive into the specifics and learn more about the importance of AI in improving customer service in the retail sector.

Deciphering Customer Behavior

Consumer behavior, which once was a labyrinth, is now comprehensible thanks to AI technology. Retail organizations can analyze and predict customers’ shopping habits, preferences, and purchase patterns. AI does this by combining multiple data sources like purchase history, social media activities, past interactions, and more to generate customer profiles.

Personalized Marketing

Unlike general and broad marketing strategies, personalized customer engagement yields better results. Retail organizations inject AI into marketing techniques to provide personalized recommendations, deals, and discounts. This placebo of personal attention fosters customer loyalty and propels customer retention.

Enhancing Customer Interactions

AI chatbots and virtual assistants are on their way to becoming the new normal in customer service. They provide instant responses, resolve queries 24/7, and have dynamic learning capabilities. Language barriers are breaking down, with these AI-powered tools able to communicate in multiple languages, driving globally inclusive customer service.

The increasing adoption of AI by retail organizations underlines its essential role in enhancing customer service. Retail companies are embracing it not as an optional add-on but as a key element in delivering superior customer satisfaction.

Let’s remember that AI is not about replacing the human workforce but instead acts as an enabler for efficiency and precision. Its integration into retail customer service paves the way for improved customer satisfaction, future growth, and long-term success.

Market Share of Machine Learning in Banking and Financial Services

Embracing technology has always signified progress. Now, it’s the age of Machine Learning (ML), and no industry remains untouched by its transformative touch. One of the sectors observing a significant impact is banking and financial services, and it’s indeed intriguing how ML is reshaping its landscape.

Machine Learning algorithms can sift through enormous data and predict trends, enable better decision-making, and create more efficient processes. Thus, it’s not a surprise that the banking, financial services, and insurance (BFSI) sector has emerged as one of the leading adaptors of ML. Yet, quantifying this adaptation was primarily anecdotal until recent studies brought interesting insights to light.

Interestingly, the BFSI sector accounts for 18% of the total global market for Machine Learning. This figure attests to the increasing dependency and trust these industries place on ML for various processes.

Banking and financial institutions exploit ML in ways more than one:

- Fraud detection: Anomaly detection systems powered by ML swiftly pinpoint suspicious activities, protecting customers from potential fraud.

- Customer Segmentation and Personalization: ML algorithms help provide personalization at scale by segmenting customers based on their behavior and preferences, thus enhancing customer experience.

- Risk Management: Predicting future trends, potential pitfalls, and credit risks based on historical data becomes easier and more accurate with ML.

- Chatbots: ML-powered virtual assistants are helping banks provide 24/7 customer service, ensuring immediate response to queries and grievances.

- Algorithmic Trading: ML algorithms help predict market trends, enabling trading systems to make real-time decisions, thus increasing profitability.

While the BFSI sector is already reaping considerable benefits from machine learning, its potential remains substantially untapped. As machine learning technology evolves and its applications broaden, we can anticipate an increase in this market share.

As the BFSI sector continues to delve deeper into the realms of machine learning, one can assert that the figure of 18% is just the beginning. ML has immense potential that is yet to be explored in the sector, opening doors to smarter banking & financial solutions. Thus, the expansion of machine learning in this sector signifies not just a trend, but a long-term investment contributing to the global economy’s future.

Use Cases of Generative AI in Banking Sector

The Expanding Role of Generative AI in Banking

As disruptive as it is innovative, generative AI has rooted itself deeply into many sectors, and banking is no exception. Banks and financial institutions harness the power of generative AI to revolutionize customer experiences, hasten operational processes, and bolster overall security.

Transforming Customer Service

The most notable use of generative AI in banking is in the realm of personalized customer service. To illustrate:

- Banks utilize AI chatbots to manage customer queries round-the-clock. These virtual assistants not only respond rapidly but also learn from every interaction, improving their own service delivery with time.

- AI is used to create personalized banking products for customers based on their spending habits, income, and personal financial goals.

- Predictive analytics, a critical offshoot of AI, is used to forecast customer behavior and help banks tailor their services accordingly.

In essence, generative AI presents a paradigm shift in the way bank-customer interactions are approached, creating more meaningful and effective engagement.

Streamlining Banking Operations

The application of generative AI extends far beyond customer service. One of its pivotal roles is in expediting tedious banking procedures. For instance:

- AI systems can quickly process large volumes of data for credit underwriting, reducing the time taken for loan approvals.

- Banks are leveraging AI analytics to detect fraudulent transactions, markedly elevating their security measures.

- AI-powered algorithms assist in risk assessment and management, helping banks make informed decisions and proactive strategies.

Thus, generative AI operates as an indispensable engine powering operational efficiency in banking.

Securing Banking Processes

In today’s digital age, security is a prime concern for banking institutions. Generative AI serves as a formidable ally in securing banking processes.

- Because of its capacity to ‘learn’ from historical pattern data, AI can foresee potential security threats and risks.

- In cases of fraud detection, not only can generative AI identify abnormal behaviors, but it can predict and adapt to new, unforeseen fraud tactics.

“As a transformative force, the use of generative AI in banking holds vast potential. As it grows in sophistication, so will its applications and influence on the banking and finance industry.” – an insider’s perspective.

In short, Generative AI plays multiple roles in banking, catalyzing a seismic shift in how the industry operates. Its relevance is only set to escalate in the coming years as AI technologies mature. Engaging with AI now is not merely an option for banks; it’s imperative for future growth and sustainability.

Conclusion

Embracing AI and machine learning for enhancing customer experience is no longer a choice for businesses, especially in the Banking and Financial Services sector. There’s so much that AI can offer in revolutionizing customer service, from boosting efficiency to understanding customer needs better, hence driving customer satisfaction to new heights. However, recognizing potential risks, such as security breaches and fraud, is equally of utmost importance.

The wave of augmented customer experience driven by AI and machine learning is sweeping across the industry, and those who do not adapt risk falling behind. AI Consulting and SaaS Sales are committed to helping businesses navigate this shift comfortably. Our team provides excellent consultation and products, ensuring businesses can significantly drive performance whilst mitigating risks associated with AI and machine learning integration.

Networking synergies, deepening customer understanding, augmenting security and driving efficiencies – these are just some of the advantages that our AI services bring on board. Feel privileged to partner with clients and startups, exploring together, the vast terrain of AI capabilities. For those looking to join us on this exhilarating journey of AI revolution, we encourage reaching out to us via this link. Changes are moving fast, and there’s no better time to get ahead than now. Together, we can shape a promising, AI-enabled future in Banking and Financial Services.

Nevertheless, as we forge ahead in our AI journey, it is critical to remember that technology should nurture, not neglect, the human elements of customer service. After all, technology is only as good as how we use it. Let’s leverage it to foster connections, not just transactions, for a more vibrant, inclusive financial future.

Frequently Asked Questions

- What is generative AI?

Generative AI is a type of artificial intelligence that can generate new and original content, such as images, videos, text, and even music. It uses deep learning techniques to understand patterns and create new content based on those patterns.

- How can generative AI revolutionize customer service in the banking sector?

Generative AI can revolutionize customer service in the banking sector by automating repetitive tasks, providing personalized recommendations, and improving the overall customer experience. It can enable chatbots to understand and respond to customer queries more accurately and efficiently.

- What are some use cases of generative AI in the banking sector?

Some use cases of generative AI in the banking sector include virtual assistants for customer support, automated fraud detection and prevention, personalized financial planning and investment advice, and automated credit scoring and loan approval processes.

- Are there any challenges to implementing generative AI in the banking sector?

Yes, there are challenges to implementing generative AI in the banking sector. These include ensuring data privacy and security, addressing ethical concerns around AI decision-making, and maintaining regulatory compliance. Banks need to carefully consider these factors before implementing generative AI solutions.

- Can generative AI completely replace human customer service representatives in the banking sector?

While generative AI can automate some customer service tasks, it is unlikely to completely replace human customer service representatives in the banking sector. Human interaction and empathy are still crucial for handling complex customer queries and providing a personalized banking experience.