The future of banking is not what it used to be, and AI technology is the game-changer stirring up the revolution. In particular, Generative AI has swiftly established itself as an aid capable of transforming traditional banking services, enriching customer experiences, and supercharging marketing and sales strategies. Generative AI leverages machine learning techniques to produce new and advanced ideas, patterns, and strategies based on existing data sets. This cutting-edge technology presents a stirring vision of banking that is proactive, personalized, and above all, powered by data.

As you dive into this article, expect to understand how Generative AI is making waves in the banking sector, fostering customer experiences that spark loyalty, safeguarding operations against fraud, and streamlining regulatory compliance. Further, we will explore how it animates personal banking, assists in accurate credit assessment, and enhances financial planning through data-driven insights. So let’s embark on a thrilling journey to explore the myriad of use cases accompanied by Generative AI in banking for enhanced customer services, successful marketing, and effective sales.

Potential Value of Generative AI in Banking

Imagine a world where banking operations run as efficiently and flawlessly as a well-oiled machine. Balancing the books, managing customer relations, strategizing product offerings – all without a hitch, not by human hands, but with the aid of advanced artificial intelligence. Yes, we’re talking about generative AI, a groundbreaking technology that’s revolutionizing the way we approach banking.

Artificial Intelligence (AI) has undeniably been a game-changer across various industries, and the banking sector is no exception. Considered one of the most disruptive forms of AI, generative AI has the potential to catalyze unprecedented progress in the field of banking. Even more impressive is the astounding value it will likely bring to the table. Experts are estimating that Generative AI could contribute between a staggering $200 billion to $340 billion annually to banking, accounting for 9%-15% of banks’ operating profits. This significant figure underscores the impressive capabilities of this cutting-edge technology.

Generative AI is not just a trendy buzzword in the tech space; it’s an intelligence system capable of generating new datasets from existing data. In the context of banking, it means AI systems are capable of producing robust risk models, creating personalized financial solutions, and even providing forecasts – tasks typically managed by large teams of human staff. These exciting possibilities signal a more streamlined future for banks and their customers alike.

- Streamlined Risk Management: One of the most critical applications of generative AI in banking is risk management. Generative models help analysts develop more robust risk models, enabling banks to make informed decisions and avoid potential pitfalls. This improved efficiency equates to higher profit margins and a decrease in resources used.

- Personalized Financial Solutions: Generative AI can learn from countless data points to provide highly personalized financial advice and solutions to customers. This level of personalization can lead to improved customer satisfaction, retention, and ultimately, profit.

- Predictive Forecasting: By drawing on historical data, generative AI can generate predictive models for future market trends, helping banks stay ahead of the game and plan their strategies accordingly.

While the advent of generative AI in banking is exciting, it’s important to note that this is not the elimination of the human touch. Instead, it’s a tool to handle routine tasks, thus freeing up human resources to focus on complex problem solving and interpersonal customer relationships.

“Generative AI has the potential to bring yet untapped value to the banking industry. This ground-breaking technology could contribute to tremendous annual operating profits,” say industry experts.

With the profound influence and scope of generative AI, banking as we know it today is set to transform. The adoption of this technology is not just advantageous, but it’s fast becoming essential to stay competitive in the rapidly evolving banking landscape. By embracing generative AI, banks can unlock their potential and herald an era of heightened efficiency and customer satisfaction. It’s high time banking reaped the benefits of the AI revolution.

Automated Data Extraction and Research Acceleration through Generative AI

As the world continues to evolve technologically, it’s no secret that artificial intelligence (AI) plays a pivotal role in various industries. One of the most influential types of AI you may have heard of is generative AI. With the power to automate data extraction and accelerate research, this advanced technology is revolutionizing sectors, particularly in banking, producing deeper insights and facilitating swift decision-making processes.

Streamlining Data Extraction

Traditionally, data extraction in the banking industry has been a manual and time-consuming process. However, with generative AI, it’s a whole new ballgame. This intelligent system can automate the extraction, saving significant amounts of time and reducing human error, resulting in refined and more accurate data at your fingertips. Here are the key benefits gained from this automation:

- Efficiency: Manual extraction is costly and time-consuming. With generative AI doing the hard work, companies spare precious resources for other quality-boosting endeavors.

- Accuracy: Human error may lead to inaccuracies in data, which can disrupt a company’s workflow. However, generative AI ensures a high level of accuracy, paramount to maintaining data integrity.

- Scalability: Generative AI can manage large amounts of data easily, allowing scalability for companies to keep pace with their growing needs.

Unlocking the Power of Research

Research is crucial for industries like banking, providing insights needed to make significant and strategic decisions. Generative AI accelerates this process, simplifying complex patterns and predicting future trends, thus empowering businesses to stay ahead in the competition. Here’s how banking research can flourish with generative AI:

- Predictive Analysis: With access to vast amounts of data, generative AI can identify patterns and trends, predicting future outcomes to mitigate risks and seize opportunities.

- Decision Making: The predictive power of generative AI aids decision-making, providing administrators with strategic insights to guide actions effectively.

- Customer Insights: Generative AI can analyze customer behaviors and preferences, enabling the banking sector to improve its user experience and maximize customer satisfaction.

As evidenced by these applications, the use of generative AI for automated data extraction and accelerated research is a paradigm shifter. It equips the banking industry, among others, with a robust tool that considerably enhances efficiency, accuracy, and predictive capabilities.

Integration of generative AI is not just a technological upgrade – it’s an investment for the future. It offers unprecedented platforms for insights and growth, ultimately steering the banking industry towards innovation and success. Embrace this change, and revolutionize your approach to handling data and conducting research. Don’t just stay in the game, redefine it!

Generative AI in Personalized Customer Interactions

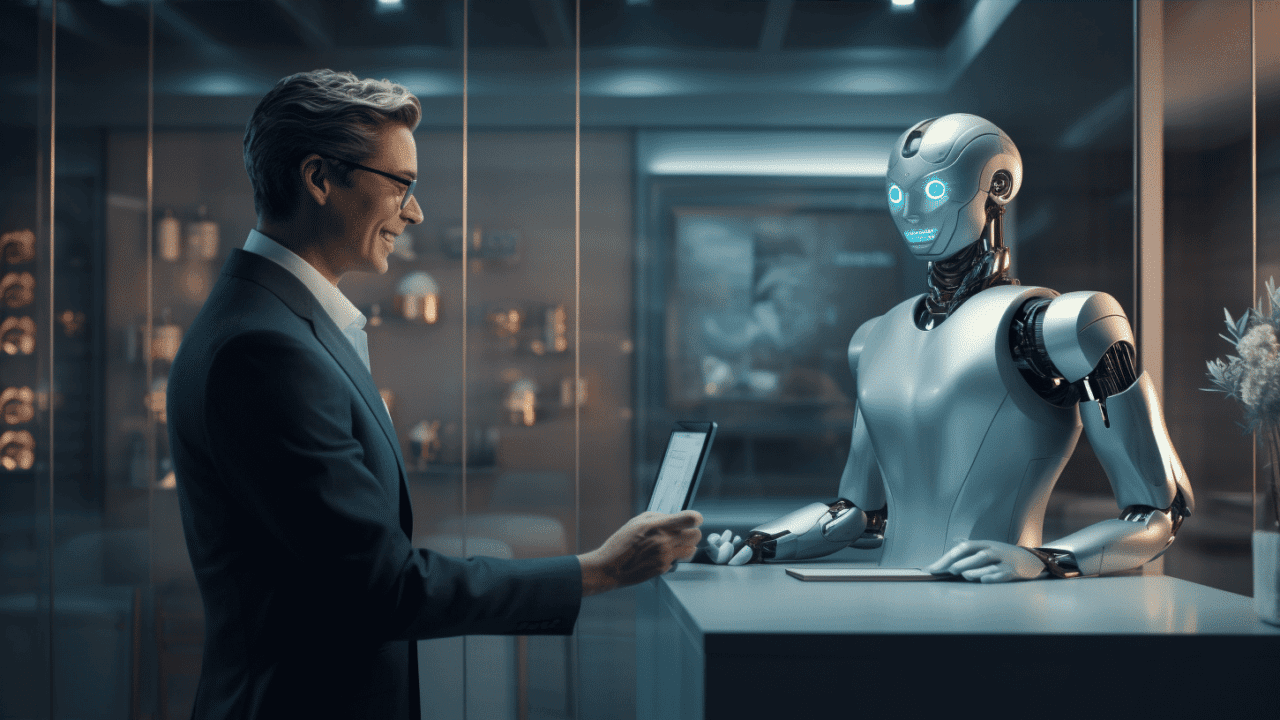

Generative AI is increasingly redefining how businesses interact with their customers. The rapid emergence and adoption of machine learning technologies have been transforming the world of customer service, resulting in highly personalized experiences. Beyond just predicting outcomes and preferences, the power of Generative AI allows businesses to simulate customer responses and intelligently adapt their strategies to maximize customer satisfaction. It’s like having a crystal ball that not only predicts the future but also allows businesses to shape it. Now, let’s dive deeper into how Generative AI is rewriting the rules of customer interactions.

Improved Credit Scoring

At the intersection of personalization, efficiency, and risk mitigation lies Generative AI’s role in credit scoring. Traditional credit models are often hindered by their lack of adaptability and personalization; however, this is not the case with Generative AI. It can seamlessly analyze vast amounts of data, study patterns and trends, and predict potential risk with uncanny accuracy. Moreover, it does so in a highly personalized manner, adjusting its predictions to each individual’s unique financial behavior.

- Seamless Data Analysis: Generative AI can analyze vast data sets quickly and effectively. It can track borrowing and repayment patterns, income changes, and even subtle shifts in spending habits. This granular-level analysis allows for highly accurate credit scoring.

- Pattern Recognition: Artificial intelligence is remarkably adept at detecting patterns. By learning a user’s financial habits over time, it can predict future behavior with a great degree of precision.

- Personalized Risk Prediction: For each customer, Generative AI generates a unique risk profile, predicting their likelihood of defaulting on payments. This makes for a highly personalized and adaptive credit scoring system, inherently more fair and effective than traditional methods.

Enhanced Customer Experience

The beauty of Generative AI lies not just in its ability to predict but also to create. From simulating human-like conversations to creating personalized customer journeys, Generative AI is the driver behind many innovative customer experience enhancements.

- Simulated Conversations: Generative AI powers the next-gen chatbots which can interact like humans, understand different emotions, and create a warm, humanoid conversation.

- Personalized Journeys: This technology enables companies to create highly personalized customer journeys. It analyses patterns, understands personalized needs, and recommends products or services based on individual tastes and preferences.

- 24/7 Support: By leveraging AI, businesses can ensure round-the-clock personalized customer service, thereby increasing customer satisfaction and loyalty.

In a world where customer preference and industry scenarios change at lightning speed, Generative AI serves as a bastion of adaptability and personalization. By improving credit scoring mechanisms and bringing unprecedented improvements to customer experience, Generative AI is changing the game in customer interactions. So, as we forge ahead into an increasingly technology-driven era, the role of AI in elevating customized customer interactions will only become more crucial, offering exciting possibilities for businesses willing to embrace its power.

Combating Fraud and Anomaly Detection with Generative AI

In navigating the vast landscape of modern technology, many entities grapple with a herculean task: battling ever-evolving fraudulent schemes. Whether it’s a corporation hunting for financial anomalies or an individual wary of illegitimate online transactions, the compelling need to reinforce security measures is undeniable. An emerging juggernaut in this multipronged battle against deception is Generative Artificial Intelligence (AI). This technological marvel has the prowess to simulate complex scenarios, identify transaction anomalies, and remarkably, streamline conversational finance.

Generative AI sets itself apart with its uncanny ability to weave intricate patterns from raw data. Unlike traditional AI systems that follow predefined instructions, Generative AI unleashes dynamic responses, curating its learning from underlying patterns or structures. It is this capability that empowers Generative AI to assist in areas where traditional systems can’t tread.

- Simulating Risk Scenarios: Conventional systems, at best, can warn of existing risks based on set parameters. But the rapid escalation of technology and its accompanying threats demand sophisticated countermeasures. Generative AI, with its innate design to synthesize and predict patterns, can simulate risky scenarios before they manifest. This feature creates a ‘trial by fire’ platform without any real-world calamities.

- Detecting Transaction Anomalies: Unusual transaction patterns can easily be overlooked in the deluge of modern financial activities. Generative AI can dive into this chaotic sea of data and fish out anomalies effectively. While typical AI systems can flounder in such disorderly data landscapes, Generative AI sails smoothly, parsing a plethora of transactions for potential outliers.

- Engaging in Conversational Finance: Perhaps, the most enticing aspect of Generative AI is its ability to master the art of conversation. Replicating human finance advisors, it can provide personalized finance advice, transacting seamlessly with humans. It’s a fantastic achievement of machine learning, where users can engage in finance-related discussions with an AI, feeling as if they’re talking with an actual financial advisor.

“The future of AI lies in Generative AI. It’s not just predicting, but creating.“

Generative AI, in essence, is an active participant in the ongoing warfare against fraud and deception. With features such as simulating risk scenarios, identifying transaction anomalies and spearheading conversational finance, it promises to revolutionize the way we combat fraud. It’s like a vigilant sentinel, ceaselessly patrolling the complexities of the financial domain, detecting and preventing fraudulent activities before they wreak havoc.

Remember, a fraudster may be intelligent, but Generative AI is invariably smarter!

Generative AI for Regulatory Filings and Stress Testing

It’s no secret that the financial sector is abundant with complex regulations and intense scrutiny. Amidst this complexity, companies spend innumerable hours and substantial resources preparing regulatory filings, conducting dreaded stress tests, and ensuring overall compliance. But, what if these demanding tasks could be simplified? Enter the world of Generative AI. This innovative technology is poised to revolutionize various facets of financial operations, including regulatory filing and stress testing.

Unpacking the Potential of Generative AI

Deep Learning algorithms underpin Generative AI. These algorithms can be trained to understand and extract patterns from vast amounts of complex financial data. As a result, Generative AI has the potential not only to automate but also to refine several manual processes in the financial domain.

- Regulatory Filings: Generative AI systems could revolutionize how organizations prepare regulatory filings. By understanding the underpinnings of the necessary data, these systems can generate draft filings that seamlessly align with regulatory standards. Thus, reducing human intervention and the risk of errors.

- Synthetic Data Generation: Generative AI can create synthetic datasets, replicating the characteristics of actual financial data without compromising customer privacy. This opens up enormous potential for prototyping, testing, and improving financial models in a safe and confidential environment.

- Stress Testing: Often, financial institutions struggle with the intensive process of stress testing, which evaluates how new solutions withstand adverse operating conditions. Generative AI can automate this task, generating a wide range of scenarios to assess against, saving companies time and resources.

Undoubtedly, these fascinating capabilities of Generative AI can both streamline operations and unlock further insights in the financial sector.

“Generative AI holds the key to not only optimize current financial operations but also innovate for the future.”

In essence, Generative AI can handle complex tasks such as regulatory filing and stress testing, making it an invaluable asset for the financial industry. By integrating this technology, companies can stay atop stringent regulations, respond effectively to market stresses, and initiate cost-effective transformations. So, it’s worth giving it a serious thought – let Generative AI be your next step towards smarter financial management.

Loan services and Credit analysis Enhancement Through Generative AI

In a rapidly evolving world rich with data, banking and finance industries find themselves ripe with opportunities for innovation using advanced technology. One such technology catalyzing transformative change is Generative Artificial Intelligence (AI). In particular, loan services have emerged as fertile ground where Generative AI has begun to enhance processes like personalized recommendations, credit analysis, and predicting credit risk. This insightful venture into the realms of Generative AI can offer a glimpse into a future where technology plays a greater role in decision-making processes in loan services.

Personalized Recommendation

Imagine walking into a bank with no idea which loan service best suits your needs. Digital technologies, like Generative AI, have started to eliminate this confusion. It’s capable of understanding each customer’s unique circumstance and providing personalized loan recommendations. This means that clients no longer have to grapple with complex financial information. With just a few interactions, Generative AI can tailor loan recommendations that fit perfectly into the customers’ financial requirements, offering a seamless experience during the decision-making process.

Predicting Credit Risk

Perhaps the most profound contribution of Generative AI in the loan services sector is its predictive capabilities for credit risk. Traditionally, credit risk analysis was a time-consuming task that involved in-depth scrutiny of financial records. With Generative AI, the tedious calculations and prolonged processes become simplified and accelerated.

The vast amount of data that AI can process allows risk analysts to view a comprehensive and far-reaching picture of a client’s creditworthiness. It pulls together varied and unrelated information to make accurate predictions about future behavior, a task that’s practically impossible for any human to perform. Even more, this technology keeps learning and improving, ensuring that even the most minute change in a client’s financial status isn’t overlooked.

This innovative form of AI isn’t just a tool for predicting potential outcomes; it’s also a means of protecting both financial institutions and their clients. By accurately predicting a client’s ability to pay back a loan, lenders minimize the risk involved with providing a loan, and clients find themselves protected from going into unmanageable debt.

In a nutshell, Generative AI is not just a technological novelty – it’s paving the way for smarter, faster, and more precise credit analysis and loan services. This powerful tool allows for the effective processing of data, personalizes customer service, and ensures better risk management for financial institutions. If leveraged correctly, the potential of AI to revolutionize the lending process is limitless. So, as we embark on this journey of uncharted territories, one thing is clear. The future of optimizing credit analysis and loan services identifiably rests in the hands of Generative AI.

Generative AI Aiding Market Trend Predictions and Risk Assessment

In the rapidly evolving sphere of financial markets, the ability to accurately predict trends and assess risks has become a highly sought-after capability. Here, the role of generative Artificial Intelligence (AI) emerges as a game-changer. By analyzing historical data, it can generate realistic simulations leading to predictive analytics that can identify market trends, evaluate risks, and propel the creation of novel financial products.

Generative AI is not your average predictive tool. It employs complex algorithms that can learn patterns from existing data and, unlike traditional analytical methods, it is capable of generating new data that mirrors the collected information. This leads to more accurate, insightful predictions, which can be harnessed in significant ways in the finance world.

Here’s how the generative AI technology could revolutionize the way we conduct financial predictions and risk assessment:

- Accurate Market Trend Forecast: Leveraging historical and real-time data, generative AI can forecast future market movements. From the calculated patterns in data, it can simulate upcoming trends in a realistic, actionable manner, making it a crucial tool for strategists, investors, and financial analysts.

- Robust Risk Assessment: By generating numerous plausible scenarios based on the current financial situation, generative AI can predict potential risks. The high degree of accuracy in these predictions enables businesses to prepare robust backup plans and minimize financial losses.

- Innovation in Financial Products: Through scenario generation and trend prediction, generative AI aids in the development of new financial products. By predicting consumer behavior trends and intake patterns, it assists companies to focus their efforts on creating products tailored to predicted consumer needs.

As Joseph Schumpeter, the renowned economist, once said, “The essential point to grasp is that in dealing with capitalism we are dealing with an evolutionary process.” As the financial world continues to evolve, it is evident that innovative technologies like generative AI will play an integral role in shaping our understanding of market trends and risk assessments.

Harnessing the power of generative AI is undoubtedly the gateway to smarter, more effective financial planning and risk management strategies. While the tool isn’t a crystal ball giving us perfect forecasts, it’s a giant leap in the right direction, providing us with advanced, informed insights that can make the world of finance less of a guessing game and more of a calculated science.

Generative AI in Retail Banking and Wealth Management

With the advent of Artificial Intelligence (AI) technologies, the face of the global banking industry is rapidly changing. An exciting and transformative subset of AI, known as Generative AI, is reshaping crucial processes in retail banking and wealth management.

Combat Fraud

One of the most significant challenges that the banking sector faces is combatting fraud. Financial fraud, often involving complex and clever tactics, can harm a business’s reputation and result in considerable financial loss. Detecting these deceptive practices early on is critical for maintaining customer trust and business viability.

This is where Generative AI comes into play. It can learn from patterns and can generate models that replicate human behavior, making it much easier to identify unusual activities or transactions. Intricate data models can help in identifying patterns that humans may overlook due to their complexity.

Here’s the icing on the cake. With the power of Generative AI:

- It can detect fraudulent behavior even before it actually happens, thanks to predictive functionalities.

- Improvements in accuracy and speed of fraud detection significantly reduce response times.

- It also mitigates the risks associated with human error and bias in decision-making.

The benefits don’t end there, though. Generative AI holds impressive capabilities that stretch beyond the chase of cyber fraudsters.

Managing Data Gaps

AI’s ability to simulate human intelligence and decision-making is a vital asset in this era of data explosion. Data drives the banking sector, and therefore, managing, interpreting, and using it effectively is business-critical.

However, data handling and management in banking often come with the challenge of data gaps. These missing pieces of information can cause inaccurate decision-making and financial analysis. Thankfully, Generative AI excels in managing these data gaps.

- It can generate synthetic data that accurately mimics real-world data.

- By filling these data gaps, AI can ensure more accurate analytics and risk assessment.

- Not just data creation, this ingenious tech can also help in data privacy by creating synthetic data that preserves user privacy.

As a result, Generative AI does more than just aiding efficiency; it gives banking and wealth management businesses the power to navigate an increasingly digital and data-driven world with confidence and accuracy.

Generative AI brings undeniable opportunities for transformation in retail banking and wealth management. As this technology continues to mature and evolve, its potential applications seem limitless. From fraud detection to data management, Generative AI truly represents the future of intelligent banking.

Chatbots Powered by Generative AI

A quick chat with an online assistant, a terse response from a digital support center, or an interchange with a chirpy automated text messenger. What do all these have in common? They are fueled by chatbots – tireless, steadfast, and increasingly intelligent. But as the tech world races ahead, so too does the sophistication of these digital helpers. The next big wave? Chatbots powered by Generative AI.

This groundbreaking technology is not just making waves but oceanic tsunamis in the world of customer support. Especially in banking, generative AI chatbots are transforming the customer experience, but how?

Making Human-like Conversation

One of the most significant challenges chatbots face is the robotic, sometimes off-putting nature of their interactions. Generative AI chatbots, however, bring a breath of fresh air. They mimic human conversation almost to a tee, understanding context, learning from past interactions, and even using natural language processing to generate fitting responses.

No more feeling like you’re talking to a robot. Instead, customers can engage with these chatbots as though they were human, which often results in higher customer satisfaction levels.

Enhancing Customer Support in Banking

The banking sector sees an enormous volume of customer queries each day. Whether it’s a typical balance check or a tricky fraud report, chatbots are now an essential part of the journey. But it’s not just about answering queries. It’s about doing so efficiently, accurately, and in a customer-friendly manner. Generative AI chatbots ace these requirements.

Working round-the-clock, they handle an infinite number of queries promptly, reducing waiting times and boosting customer satisfaction. They’re also able to understand complex queries, provide accurate answers, and learn from each interaction – all while maintaining the conversational quality of a human support representative.

And here’s the most significant part: these chatbots remember past interactions and learn from them. So, if a customer feels disgruntled today, the chatbot might handle them with extra care tomorrow. Intelligent, isn’t it?

“Generative AI empowers chatbots to go beyond pre-programmed responses, handling a wide assortment of customer queries while providing a near-human conversation experience.”

As the world moves towards digital banking, generative AI-powered chatbots are the new front-liners, leading the charge in customer support with a blend of efficiency, accuracy, and a human-like touch. The banking sector is just the start. We anticipate seeing this technology become a part of every sector – from healthcare and education to entertainment and e-commerce.

Generative AI in Credit Assessment and Loan Underwriting

In today’s rapidly evolving technological world, an immeasurable volume of information is at our fingertips. Financial institutions, particularly in credit assessment and loan underwriting, have a golden opportunity to leverage this data to refine their operations. Among the plethora of technologies available, generative Artificial Intelligence (AI), with its remarkable potential to synthesize data and innovate investment research, has emerged as a front-runner. Let’s delve into the specifics behind the introduction of Generative AI in these important financial arenas.

Data Synthesis

One of generative AI’s core strengths lies in its ability to synthesize data. It does this by leveraging the power of machine learning algorithms to create new data based on patterns found within existing sets of information. So, how does it aid in credit assessment and loan underwriting?

Generative AI comes in handy when assessing a customer’s creditworthiness. It goes beyond analyzing a customer’s financial history or current financial standing; it creates realistic credit profiles that can predict future financial behavior. This predictive power makes it possible to effectively evaluate the likelihood of default or delinquency, leading to more informed lending decisions.

Here’s the breakdown of how generative AI aids in data synthesis:

- Streamlining data processing: AI can process enormous amounts of data efficiently, allowing for quicker and more accurate credit assessments.

- Proactive risk management: By predicting potential defaults or delinquencies, financial institutions can proactively manage risk.

- Enhanced customer profiles: AI-generated data provides a comprehensive financial profile of each customer, enabling more personalized and responsible lending.

Data-Driven Investment Research

In addition to credit assessment, generative AI is also transforming investment research. The ability to generate new, realistic data based on existing patterns allows for comprehensive analysis of potential investments. This improves the accuracy of investment predictions, giving financial institutions an edge in their decision-making process.

Leveraging generative AI in data-driven investment research facilitates:

- Market trend prediction: Using AI to analyze market patterns and generate new data can help predict future market trends.

- Risk assessment: AI can generate potential risk scenarios, helping institutions make informed investment decisions.

- Enhanced profitability: More accurate predictions and risk assessments lead to more profitable investments and a stronger financial position.

The application of generative AI in credit assessment and loan underwriting points to a future where predictive data patterns drive financial decisions. Far from replacing human judgement, this merely provides another tool to aid in decision-making. While generative AI is not a panacea, it presents a new, data-centric approach in credit assessment, loan underwriting, and investment research, promising significant optimization in these areas and heralding the dawn of an exciting era in the financial industry.

Reducing Bias and Improving Compliance Practices with Generative AI

When you think about the strive towards fair, equitable, and law-abiding practices in the banking industry, one emerging technology likely stands out from the pack: Generative AI. This sophisticated form of artificial intelligence isn’t only for curating catchy ads or creating engaging social media content; it’s on the cusp of revolutionizing credit scoring and banking compliance practices. By integrating generative AI into their operations, banks can boldly venture forward into a future that is less biased, more compliant, and ultimately more beneficial for every stakeholder involved.

Let’s start by unpacking how generative AI can mitigate bias in the all-important process of credit scoring. Anyone familiar with the banking sphere will agree that credit scoring is an integral part of financial institutions’ operations. It’s a system that, though effective in many ways, is not entirely free from human biases and prejudices. Pound for pound, generative AI algorithms are swiftly becoming an antidote to this concern.

- First off, generative AI can provide a more objective analysis of a borrower’s creditworthiness by utilizing vast data sets, eliminating biases, and offering a more quantitative, data-driven credit score.

- Secondly, this form of AI helps in identifying patterns and trends in a borrower’s behavior that may escape even the most eagle-eyed loan officer, resulting in a more comprehensive and justifiable credit decision.

- Last but not least, generative AI aids in maintaining uniformity throughout the credit evaluation process, ensuring that no customer is favored or discriminated against inadvertently.

On the other hand, enhancing compliance practices in the banking sector is yet another significant vantage point of generative AI. As regulatory bodies tighten the screws on banking regulations to maintain market stability and prevent fraudulent activities, adherence to these norms becomes paramount. Naturally, the sophistication and efficiency of generative AI come into play here, too.

- The incorporation of generative AI can result in the automatic detection and reporting of any deviation from stipulated compliance practices.

- Beyond detection, such AI models can also predict possible compliance breaches based on the current operational pattern and preempt any discrepancies.

- Most importantly, generative AI can simplify the often daunting and tedious compliance process, making it easier for banks to stay within the regulatory framework.

The use of generative AI in reducing bias and improving compliance practices within the banking industry truly heralds a progressive future. It promises a world where credit decisions are objective, computational, and impersonal, and compliance is predictive and effortless. As we further develop and understand this technology, it’s foreseeable that generative AI will become an irreplaceable part of the banking sector’s operations.

Conclusion

As we contemplate the dawn of a new era where Generative AI plays a more significant role in banking, we’re excited about the possibilities it holds to revolutionize customer service, sales, and marketing. AI implementation can provide smarter, quicker, and more personalized experiences that matter most to banking consumers.

At AI consulting and SaaS Sales, our focus is on leveraging these advancements in AI technology to enhance your business operations. Through AI-driven solutions and partnerships, we can help you meet the demands of your customers with increased efficiency and precision.

The future of banking services is here, and we are ready to help your organization transition smoothly. Reach out to us at Stewart Townsend to explore the potential of Generative AI for your banking services. Let’s shape the AI-driven banking future together!

Frequently Asked Questions

- What is generative AI?

Generative AI refers to the use of artificial intelligence algorithms to create new content, such as images, texts, or videos, that are original and indistinguishable from those created by humans.

- How is generative AI used in the banking industry?

Generative AI is used in the banking industry for customer services, marketing, and sales. It can help create personalized customer experiences, generate marketing content, and assist in sales predictions and recommendations.

- What are some use cases of generative AI in customer services?

Generative AI can be used in customer services to develop virtual assistants and chatbots that can handle customer queries, provide instant support, and offer personalized recommendations based on user preferences and behavior.

- How can generative AI benefit banking marketing efforts?

Generative AI can benefit banking marketing by generating personalized marketing content, creating targeted ads, and automating email campaigns. It allows banks to deliver tailored messages to their customers and improves overall marketing efficiency.

- Can generative AI help in sales predictions and recommendations for banks?

Yes, generative AI can analyze customer data, predict sales trends, and make recommendations to bank sales teams. It can identify potential leads, suggest personalized offers, and optimize cross-selling and upselling opportunities.

Want to hire me as a Consultant? Head to Channel as a Service and book a meeting.